Running company vehicles can be an expensive business. While poor driving can obviously put your drivers and other road users at risk, it can also cost your organisation huge amounts of money, but often in ways you may not realise.

This is the basis of any business case to invest in further driver safety. While serious incidents may be quite rare, most businesses suffer regular instances of lighter damage and increased wear and tear on the vehicles due to poor or aggressive driving. Focusing on reducing these smaller incidents and excessive costs will not only bring significant business benefits, but the safe working practices you introduce will reduce the likelihood of a more serious incident occurring.

The most obvious costs are fleet insurance and repairs arising from unnecessary vehicle damage, whether that be serious collisions or just avoidable parking scrapes. A firm with a poor claims history can easily pay three, four, even five times the amount for fleet insurance as a well-managed fleet with a good track record.

Even if you haven’t claimed on your insurance, you might be paying for the damage in other ways such as end-of-term penalty chargebacks from your leasing company that can prove very expensive.

Simple repairs such as replacing a broken mirror can cost hundreds of pounds each because many now have remote control adjustment, blind spot monitors and side repeater indicators built in.

If you buy your vehicles outright, then the reduced resale value of a poorly cared for vehicle means more money is needed for a replacement.

However, there are many hidden costs that are also involved such as the increase in admin and management time sorting out claims and repairs, right up to staff absence, vehicle off road time and business disruption if the incident was more serious.

Operational costs such as fuel, tyres, routine service and maintenance, insurance and damage repairs are often simply seen as the cost of doing business yet they can be significantly higher than they need to be when drivers and vehicles aren’t being managed properly.

Poorly managed drivers will often be prone to poor standards of driving which means they’ll often accelerate or brake more harshly, speeding and driving too close to the vehicle in front in order to keep up with their schedule. This naturally results in greater wear and tear on the vehicle and a higher chance of a collision.

Higher than average fuel use, tyre spend, maintenance costs and damage repair costs are therefore all reasonably good indicators of opportunities to improve driver safety management.

Good management is about measuring and monitoring this type of data to highlight the where behaviour is impacting costs. This will allow you to work towards:

- Reduced insurance and repair costs

- Reduced maintenance and operational costs

- Reduced fuel use and environmental impact

- Less drain on management and admin time

- Less business disruption from vehicles being off the road

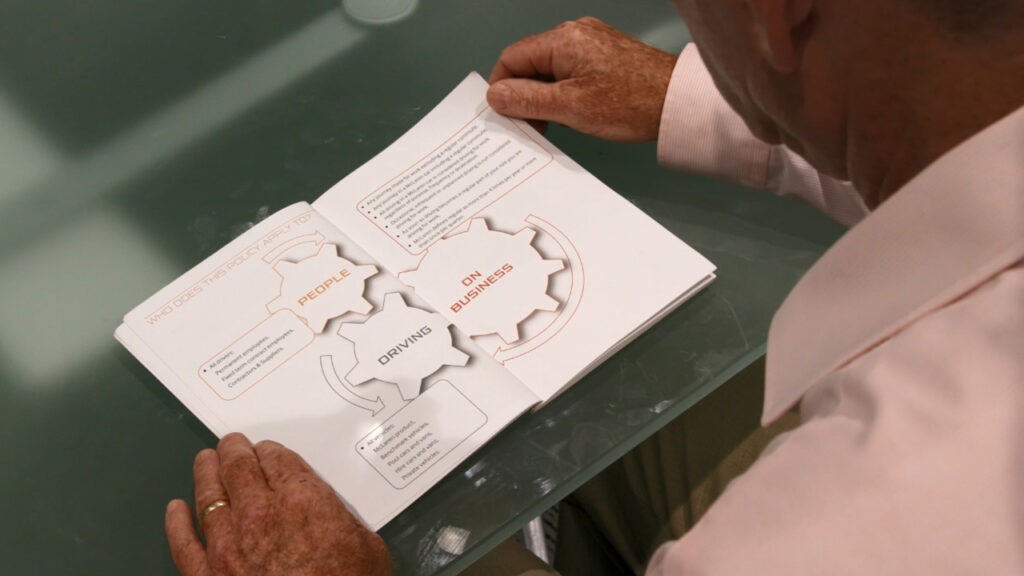

y to work activities on the road in the same way it does on a physical site.

y to work activities on the road in the same way it does on a physical site.